- Money market funds are unit trusts which invests in a variety of short-term bonds and commercial bills.

- Managed by a fund manager, they are low risk, highly liquid products with an average return of ~1% per annum.

- Unlike insurance, money market funds are not regulated and future returns are not guaranteed despite past performance.

- Conservative investors as well as those who are looking for temporary cash management, on the mid to long term basis, may consider money market funds.

I have a pool of clients who are risk averse and don’t know how to invest their savings. They parked majority of their savings with the bank. Those who are conscience on the principal of wealth being eroded by inflation will roll their fixed deposits upon renewal. Many are dismayed as their renewal rates drop year after year. Then there are clients who leave their savings with the bank eventhough they are aware of the low interest rates being offered. These clients shared with me that liquidity is important to them and they might need the funds in a few years time. Even a 5 year endowment does not appeal to them as they don’t wish to have the funds locked up. So what can we offer to help such clients with their need?

Our recommendation – Investment in money market funds

Pros:

- Short term investment grade bond funds

- Able to cash out within a week

- More than 10 years of low volatility record

- Managed by reputable fund manager

- A fund that performs during times of market stress due to flight to safety sentiments

- Better returns than bank accounts or Singapore savings bond

Cons:

- Unlike insurance, it is not a regulated product

- Like all investments, past performance does not guarantee future returns

What is a money market fund?

“According to Investopedia, a money market fund is a kind of mutual fund that invests in highly liquid, near-term instruments. These instruments include cash, cash equivalent securities, and high-credit-rating debt-based securities with a short-term maturity. Money market funds are intended to offer investors high liquidity with a very low level of risk. Though not quite as safe as cash, money market funds are considered extremely low-risk on the investment spectrum.”

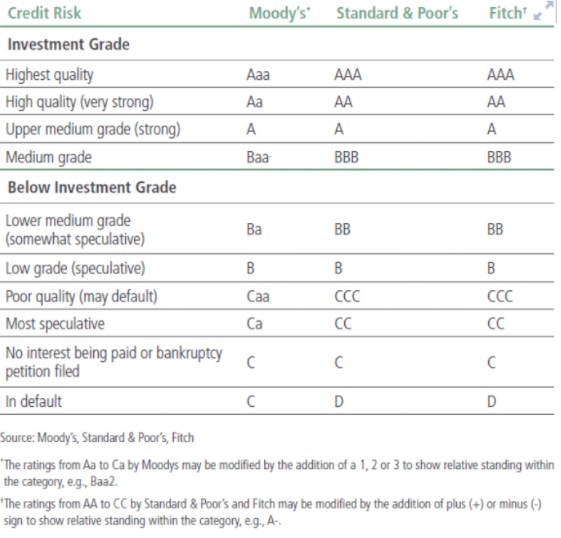

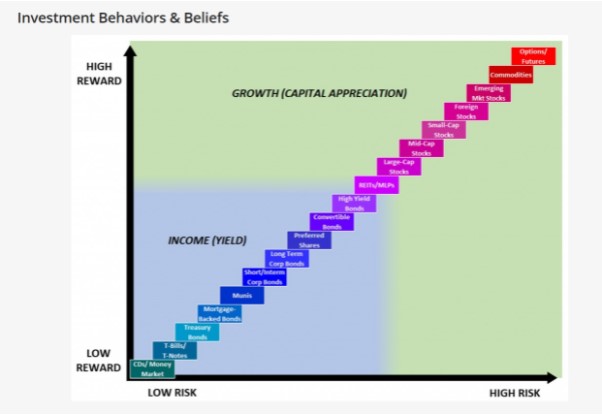

Therefore money market fund is a unit trust which invests a pool of money from investors, into a portfolio of short term yet high quality bonds (see below ranking), with the least credit/bankruptcy risk. The fund only invests in investment grade bonds. The risk of the fund is further reduced as the professional fund manager buys into a large collection of debt to diversify the risk. Retail investors can gain access to markets which are difficult for direct investments. Even though the unit trust is not listed in the Singapore Stock Exchange, the unit trust investor is able to sell with ease as the fund manager stands ready to redeem the units. Our recommendation follows 3 layers of checks to ensure that we select the most competitive fund for our clients; While we rely on the fund manager to select the assets, my investment department and I will have our own set of criterias to determine our recommendation.