How I can help you to improve your financial well-being?

Live Well Plan Well, a trusted Singapore adviser, offers one-stop solutions in investment, insurance, tax & estate planning with CPF expertise for secure legacies.

Leverage My Proprietary

3 Step Process

Make Your Savings Work Harder

Many people leave their funds in the bank simply because they are unaware of more effective ways to grow their savings. Yet, as we all know, traditional bank interest rates often struggle to even keep pace with inflation — meaning your money may lose value over time.

That’s why we focus on strategies that make your savings work harder, helping you achieve a real rate of return. Whether you prefer a conservative approach or are open to taking on more risk, we design recommendations tailored to your unique profile.

With the right guidance, you can grow your nest egg with confidence, safeguard against inflation, and enjoy the financial freedom to truly embrace your golden years.

Restructure Policies

Over time, financial products naturally change due to regulations, competition, and evolving consumer needs. That’s why it’s important to review your portfolio regularly to ensure your policies continue to meet your current goals and circumstances.

We offer flexible reviews at your convenience, helping you restructure where necessary so your policies work harder for you. At the same time, removing duplicate coverage can lead to meaningful cost savings while potentially enhancing your overall protection.

With the right adjustments, your portfolio stays efficient, relevant, and aligned with your long-term financial security.

Leverage Up

Hey there,

My name is Deon!

I started my financial advisory career in 2011 serving clients from all walks of life. While it’s not my style to brag about my achievements, client do want to know that they are served by somebody who is qualified and experienced.

Deon

Tay

Clients' Vote of Confidence

Tian Ji and Michelle

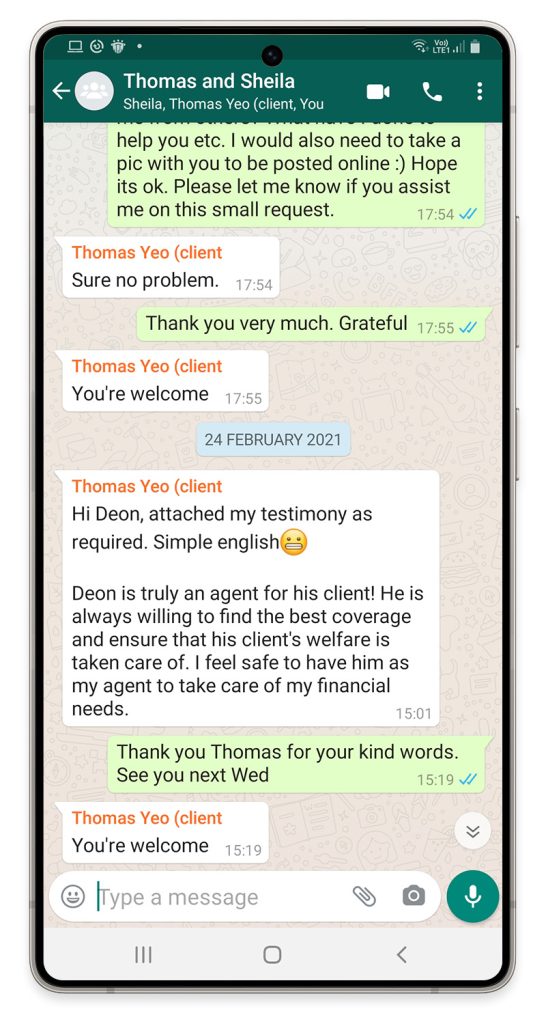

Thomas & Sheila

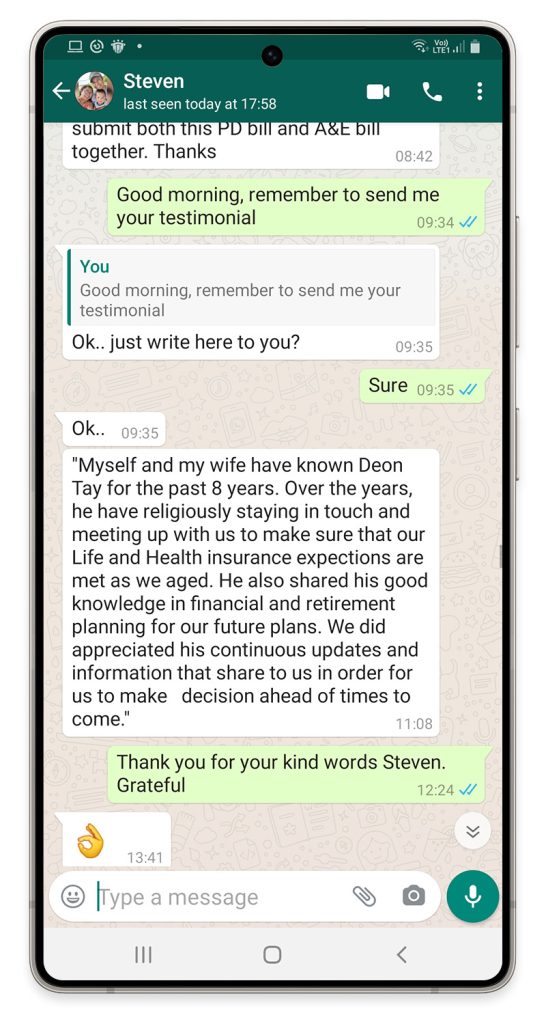

Steven

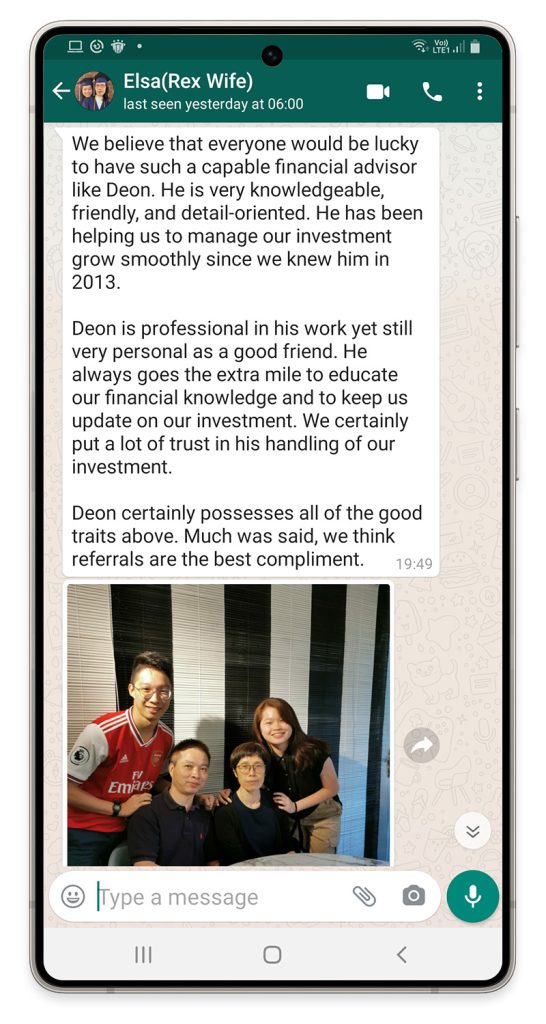

Rex & Elsa

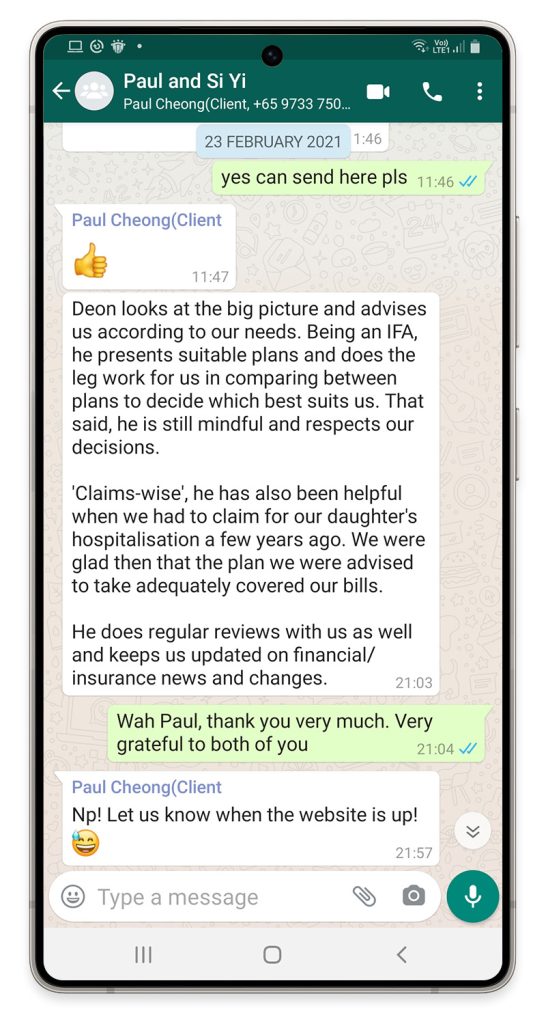

Paul & Si Yi

Michelle

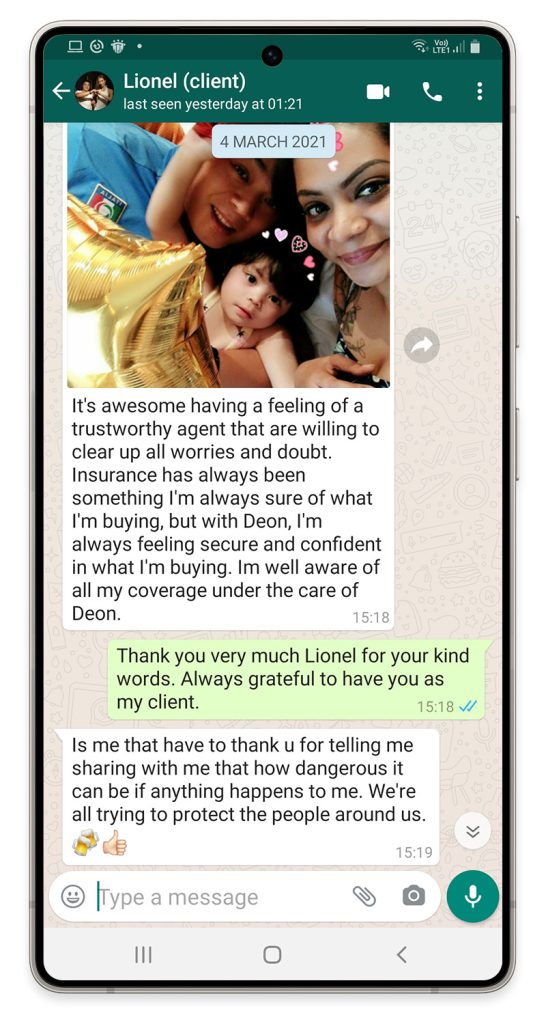

Lionel

Jeremy

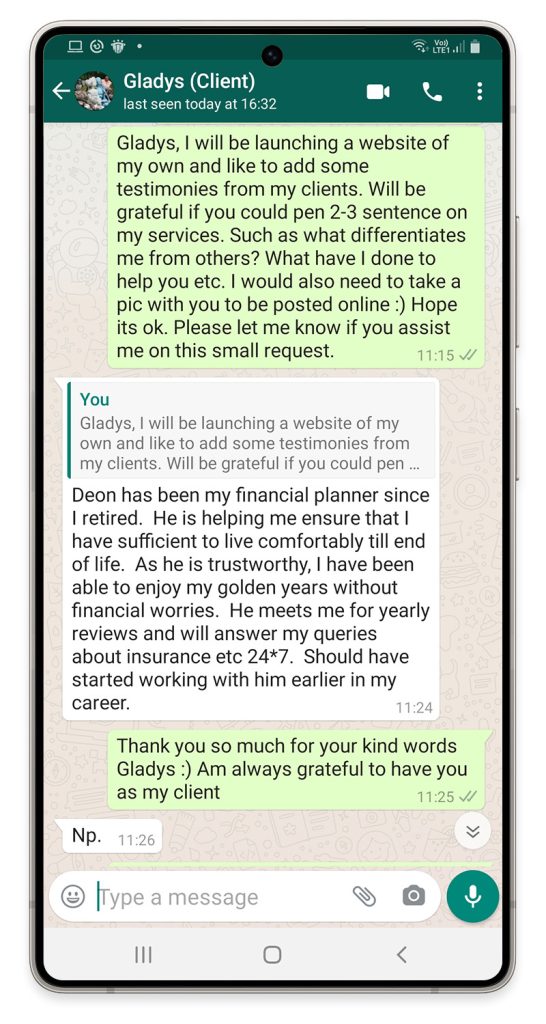

Gladys Thio

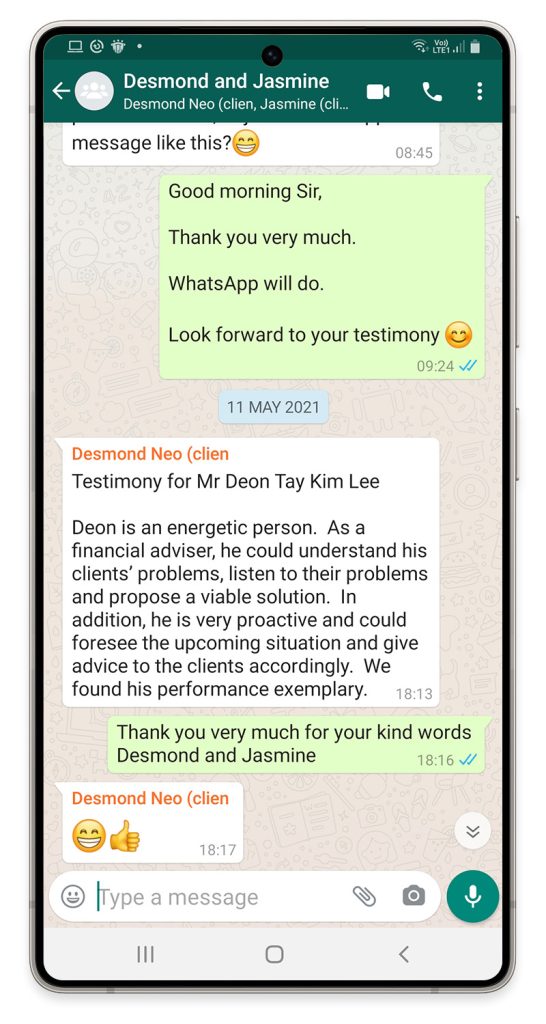

Desmond Neo

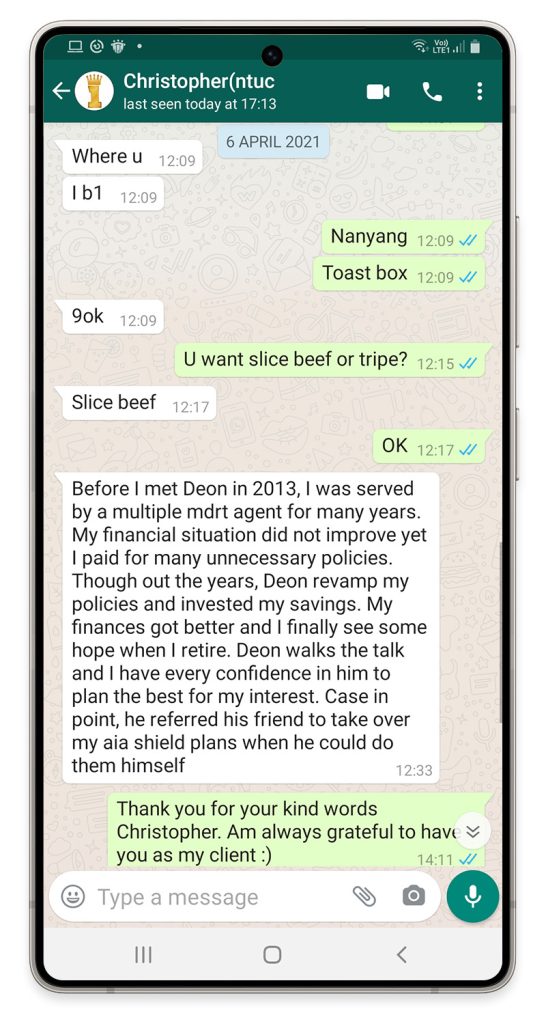

Christopher Tay

Alicia

Find Out How I Can Do The Same For you

Why should you choose me to guide you on your financial journey?

Awards and Accolades

Experience with Claims

Witness first hand my dedication to ensure your needs are served

Investment work experience

Financial adviser representative

Presenting options

One stop solution

Market updates

Stretch your savings

Tap Into My Knowledge Bank

I hope above sharing of knowledge helps the reader to make a more informed decision as insurance planning is a long term commitment. Please feel free to write to me on your comments.

How About a

Complimentary Consultation?